RELAY Corporate Finance has performed an in-depth analysis of European food multiples. This blogpost will share the insights and key takeaways.

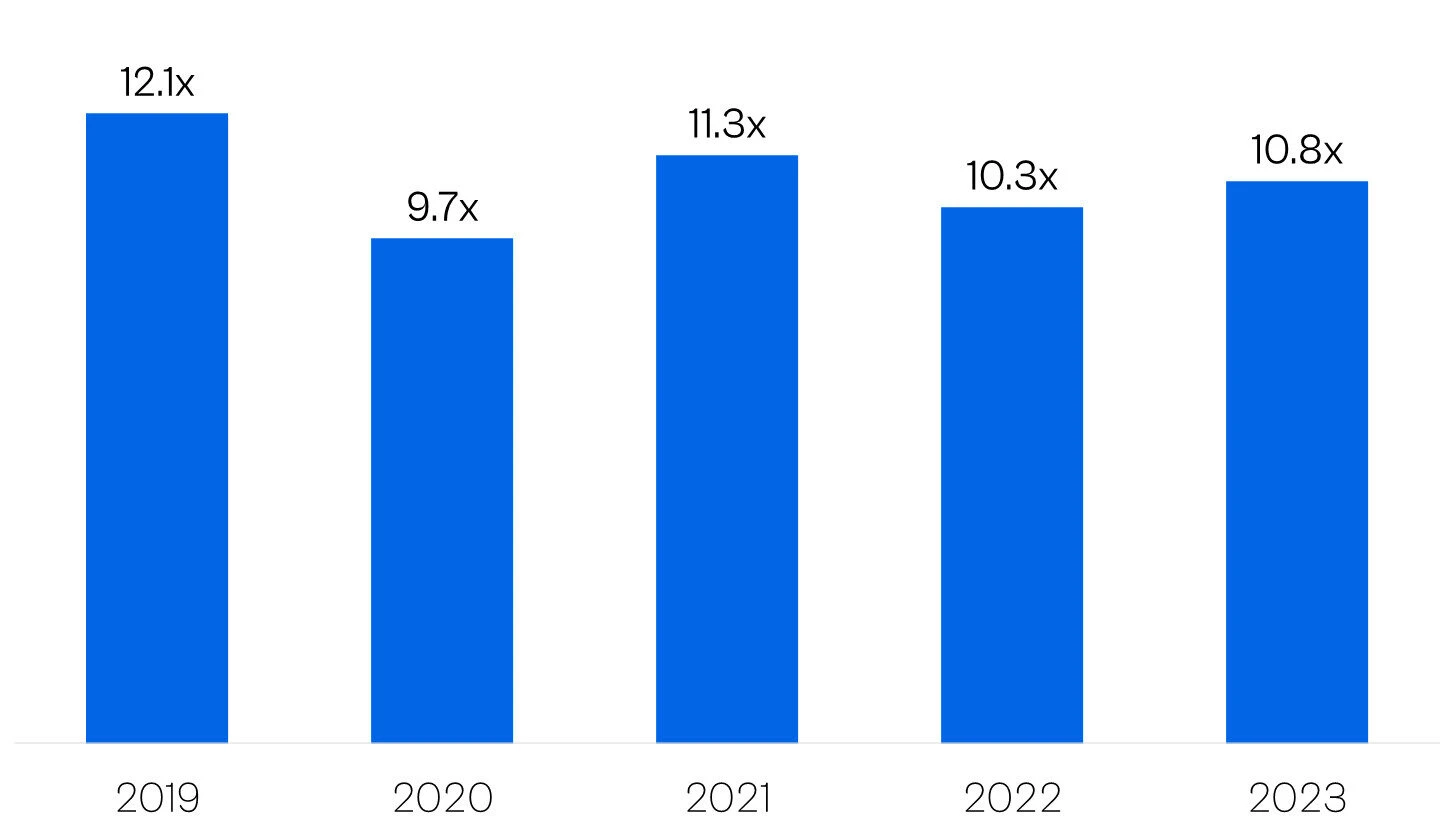

European food producing companies have been sold at steady and high EBITDA multiples during the past five years, despite serious challenges including COVID-19 and cost price inflation. This reflects underlying continued demand for food consumer goods and margin sustainability. We see valuation levels rising since the beginning of 2023 which should continue in 2024.

If you are interested in the valuation of your company or want to discuss our findings in more detail, please feel free to reach out to Maarten or a colleague of the RELAY Corporate Finance team.

Key takeaways:

- Valuation multiples are remarkably resilient throughout the years

- On a subsector level, valuations are also consistently strong, ranging from 9.0x EBITDA for non-alcoholic beverages to 15.1x for health products

- The number of transactions has halved in 2022 and 2023, reflecting caution amongst both buyers and sellers

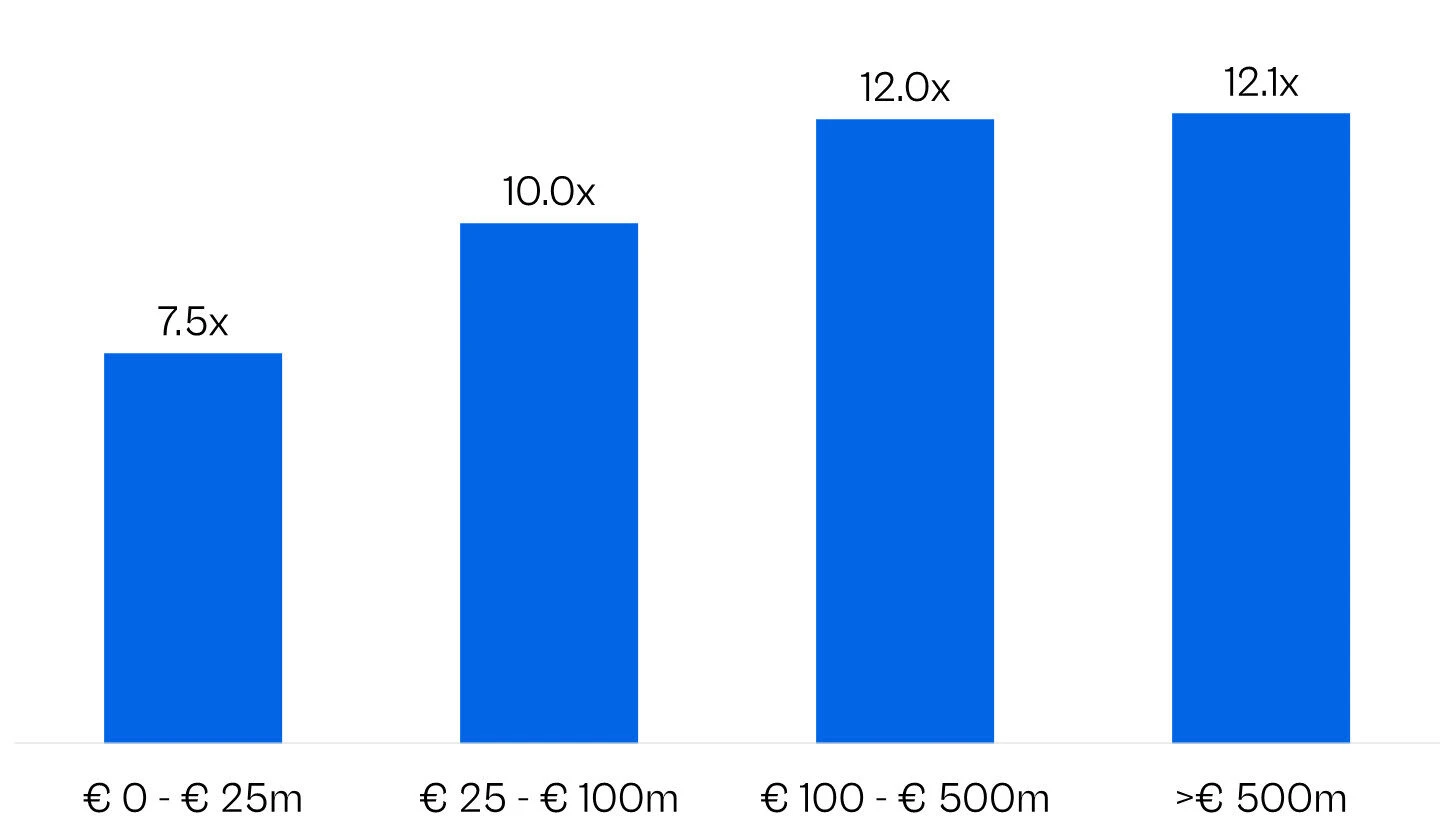

- There is a clear relationship between transaction sizes and multiples paid as the risk level of smaller companies is perceived to be higher, lowering multiples

RELAY Corporate Finance is a specialised advisory firm and we offer:

- Track records of success in Dutch linked corporate finance

- A strong international partner network for our international assignments

- Full transaction involvement of our senior partners

- Over 100 years of combined experience

- Aggregate deal value in excess of EUR 15 billion and more than 150 advisory mandates

- Deep sector knowledge in the Food & Consumer area

We will not just focus on one transaction but pride ourselves on building long term relationships.