The Dutch ICT Managed Services sector continues to evolve. The most obvious trends are the increase in cloud adoption and the consolidation that has been going on for some time. The most common customer queries to Managed Service Providers ('MSPs') relate to AI solutions.

More and more organisations are trading on-premise infrastructure for cloud solutions because of scalability, standardisation and lower costs (Connectium, 2025). In other words, less proprietary infrastructure and smaller IT teams.

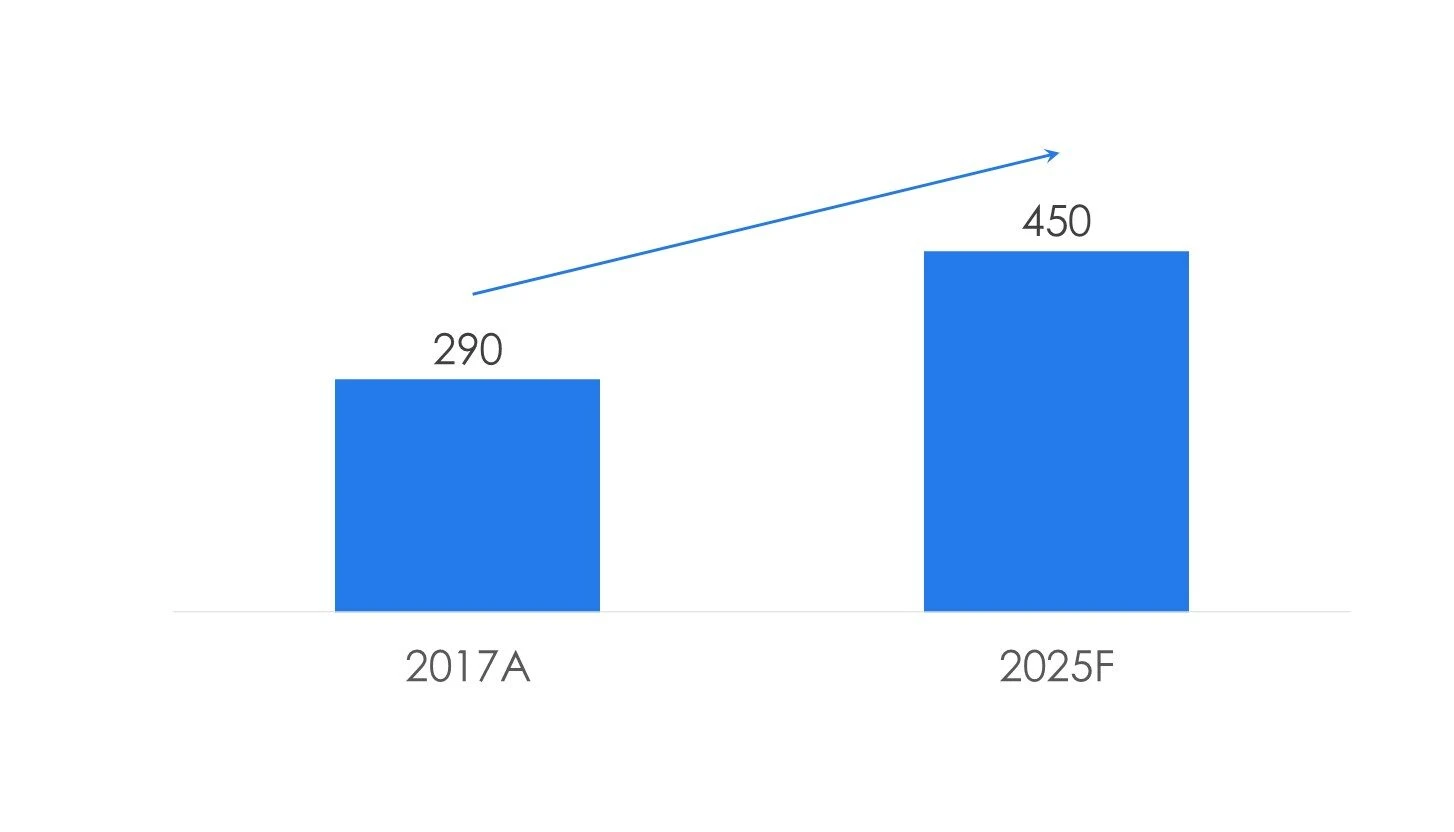

Consolidation has been going on in the sector for some time. This is driven by the need for economies of scale and horizontal integration. There is also very broad interest from (financial) investors with some 'buy & build' initiatives are active. There were 290 acquisitions annually in 2017, compared with 441 in 2024 (ING, 2025). This increase has several causes.

Customer-oriented solutions

The most frequently surveyed topic concerns AI applications, followed by cybersecurity. MSPs will need to be able to flesh out these customer expectations by being able to offer knowledge and solutions at a higher level. Also, there will be even more regulation be created, partly applicable to MSPs. It will be difficult for smaller players to have all this knowledge 'in-house'. This will also result in growth or specialisation.

Steady growth

The European Managed Services sector is expected to grow solidly in the coming years with a annual growth (CAGR) of 13.2% until 2030 (Grandview Research, 2024). The sector is expected to grow from €64 billion in 2023 to about €152 billion in 2030.

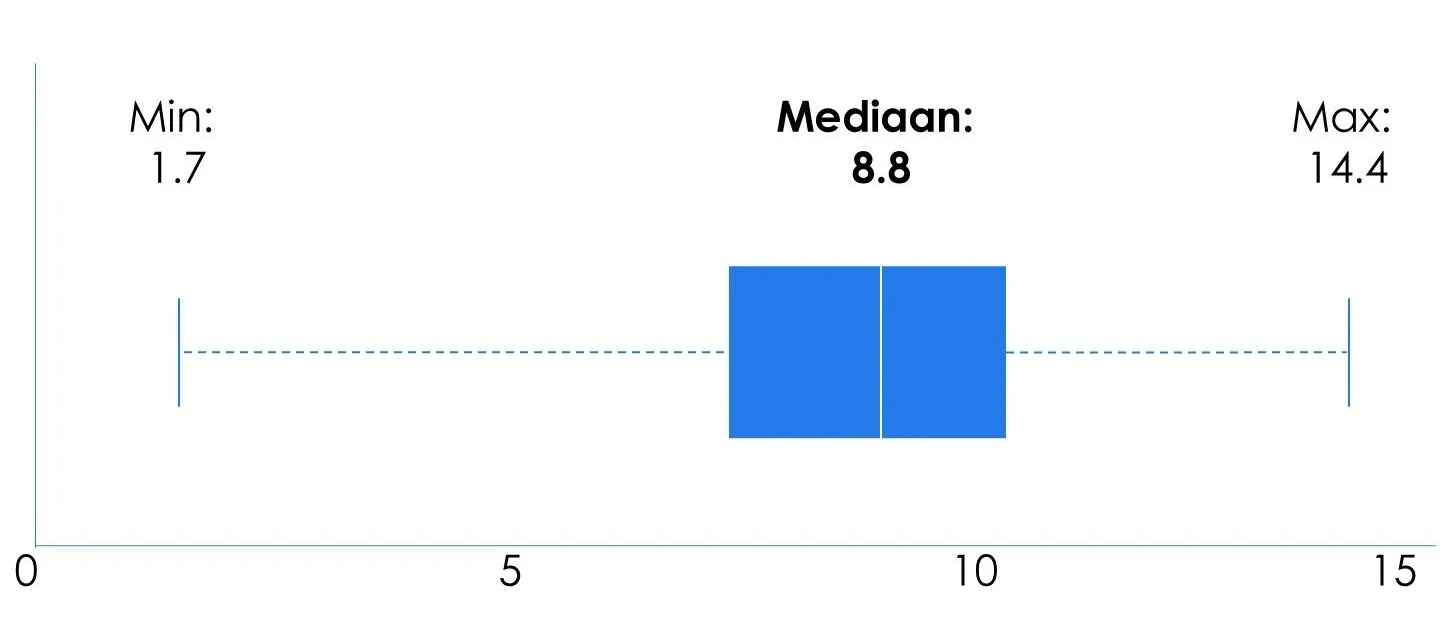

The IT sector is attractive to investors due to recurring revenues and strong growth potential. The number of acquisitions will increase further in the coming years (BDO, 2024). This is likely to be accompanied by high multiples (RELAY research based on MergerMarket, 2025), depending on size and growth.

RELAY Corporate Finance is a M&A Advisor with much experience in the MSP sector. We are happy to spar sometime about what these developments and trends can do for your organisation. Feel free to contact Irik or a colleague from the RELAY Corporate Finance team.